Introduction

Holidays are a time for celebration, but they can also bring a wave of financial pressure. Setting up a separate budget for major events like trips, holidays, and home projects allows you to plan thoroughly and track every detail. When you have a designated area for these expenses, it’s easier to manage your day-to-day finances, stay organized, and avoid unexpected holiday stress. This is where a simple Christmas Budget comes in.

One way I prepare for the holiday season is by creating a Christmas tab in my annual budget spreadsheet. I look back at previous years to see what worked, what we spent, and note any ideas that come up throughout the year. This dedicated space is like a holiday planner, always ready to help me track and fine-tune our plans.

What I Track in the Budget

In my Christmas budget tab, I focus on several categories:

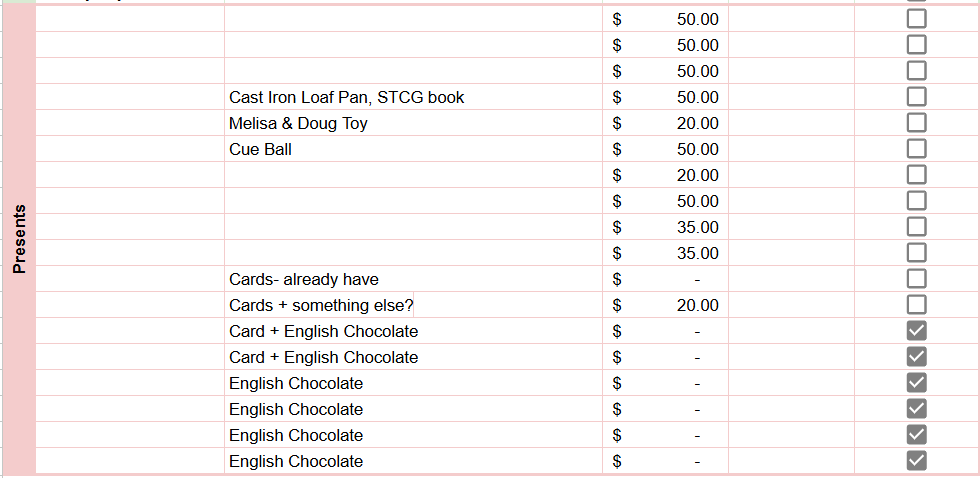

- Gifts: Listing each person I plan to buy for, alongside gift ideas and estimated costs. This way, I can adjust the list if our budget changes.

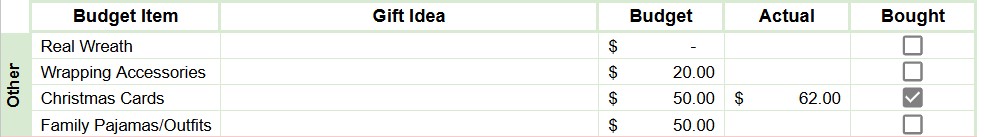

- Decorations: New decorations or replacements, like ornaments or outdoor lights, often sneak up on us, so this line item helps me keep tabs. TI include things like wrapping paper, bows, bags, a real wreath for our door in this category as well.

- Christmas Cards: Usually every fall we get family photos done and I use Wallgreens Photo to print a 5×7 christmas card. This line item includes those cards and stamps.

- Family Pajamas/Outfits: We don’t do this every year, but I enjoy having the line item because it reminds me to look for these sooner rather than later (Old Navy or Target usually has good options for the whole family).

Tracking these categories gives me clarity and prevents last-minute surprises that would otherwise throw off our overall budget.

The best part of a budget is that it is flexible and you can adjust these categories to reflect your families specific expenses. Other common categories may include: Holiday travel, special outings & events, Holiday baking (I am able to include this in our usual grocery budget but it may be helpful to break out), pet gifts/treats. Let me know in the comments what categories you are going to include in your budget.

Countdown to Christmas Formula

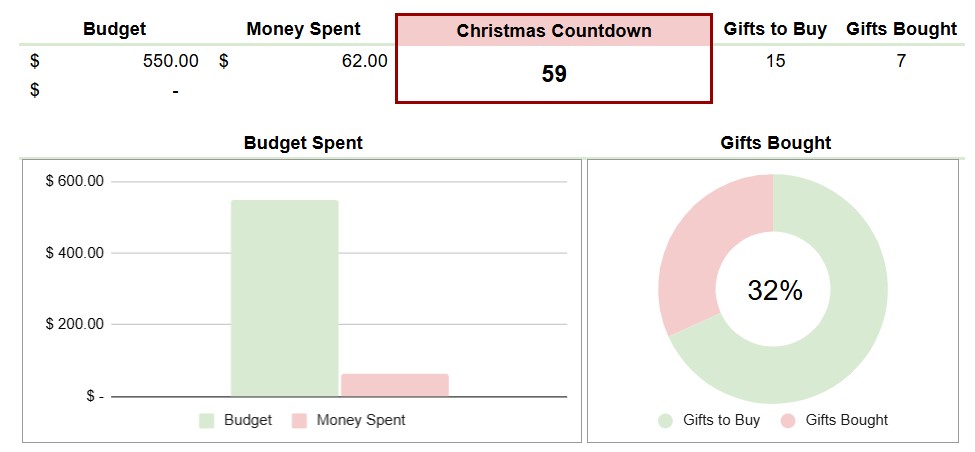

I also love adding a countdown to Christmas in my budget tab! In Excel or Google Sheets, you can use this simple formula to keep track of the days left:

For example, Christmas is on December 25, 2024, the formula is:

=DATE(2024,12,25)-Today()

Every time I open my Christmas budget, I’m reminded of how many days are left, helping me pace our spending and stay on track.

What I Budget For

The categories I track evolve each year depending on our plans and income. As a one-income household this year, we’ve made significant adjustments to reflect our current situation, which means less on decorations and presents, but still budgeting carefully for family traditions.

Real Numbers: Setting Our Christmas Budget

Choosing a budget amount each year depends on a few key factors: our income, other financial goals, and any unique plans for the season. Here’s a general outline of our approach:

- Review Past Budgets: I look at our Christmas budget from previous years to see where we can cut back or plan smarter.

- Estimate & Adjust: I estimate based on past spending and adjust for our current income. This year, we’re significantly reducing our budget to stay within our means.

- Prioritize Traditions: By setting priorities on what’s most meaningful, I ensure that our holiday season feels full, even if we’re spending less.

It is so hard to compare your holiday season to the ones you see on Social Media however, I want to share my real budget that shows we are only going to spen $550 on the holidays. It will be hard but it will be worth it. A budget also isn’t a restriction it lets me feel confident in the money we do spend and when January rolls around we won’t be trying to figure out how to cover all of our holiday spending.

Benefits of a Holiday Budget

- Clarity and Peace of Mind: A dedicated holiday budget means I know exactly what we can afford, which reduces stress and keeps the holidays enjoyable.

- Better Decision-Making: Having a clear plan allows me to make smarter decisions and take advantage of sales without the pressure.

- Financial Goals in Focus: By keeping our Christmas spending within its own budget, I protect our everyday finances and keep our long-term goals intact.

Setting up a separate Christmas budget has become a holiday essential. With a little planning and intentional spending, we’re able to enjoy the season while staying within our means, and that’s truly a gift in itself.